First indications of housing market cooling

2021 was the year of the overheated real estate market, will 2022 be the year of the return to a more stable market? Realo, the real estate data platform, analysed almost a million unique ads to map the current state of affairs in Belgium.

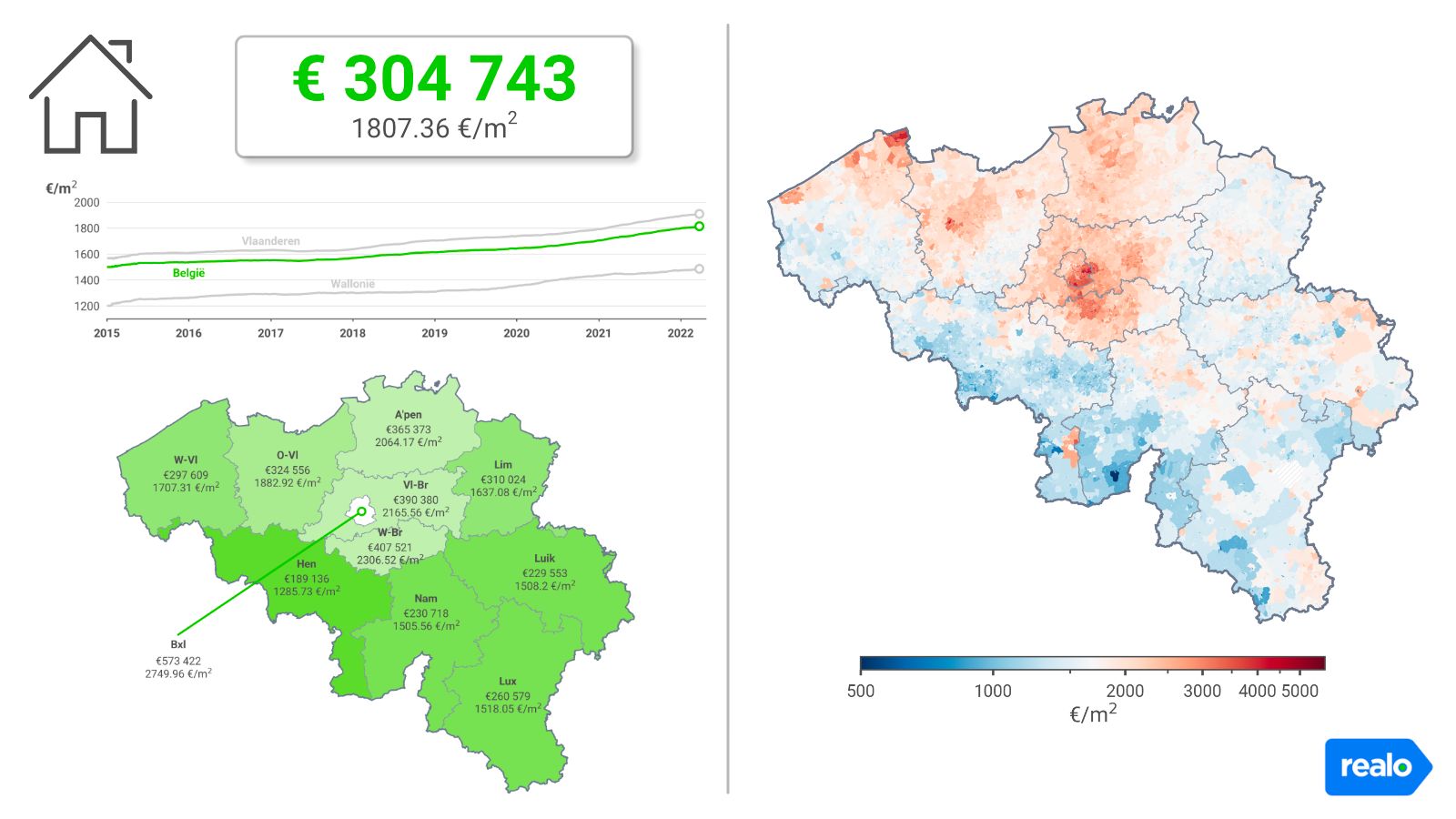

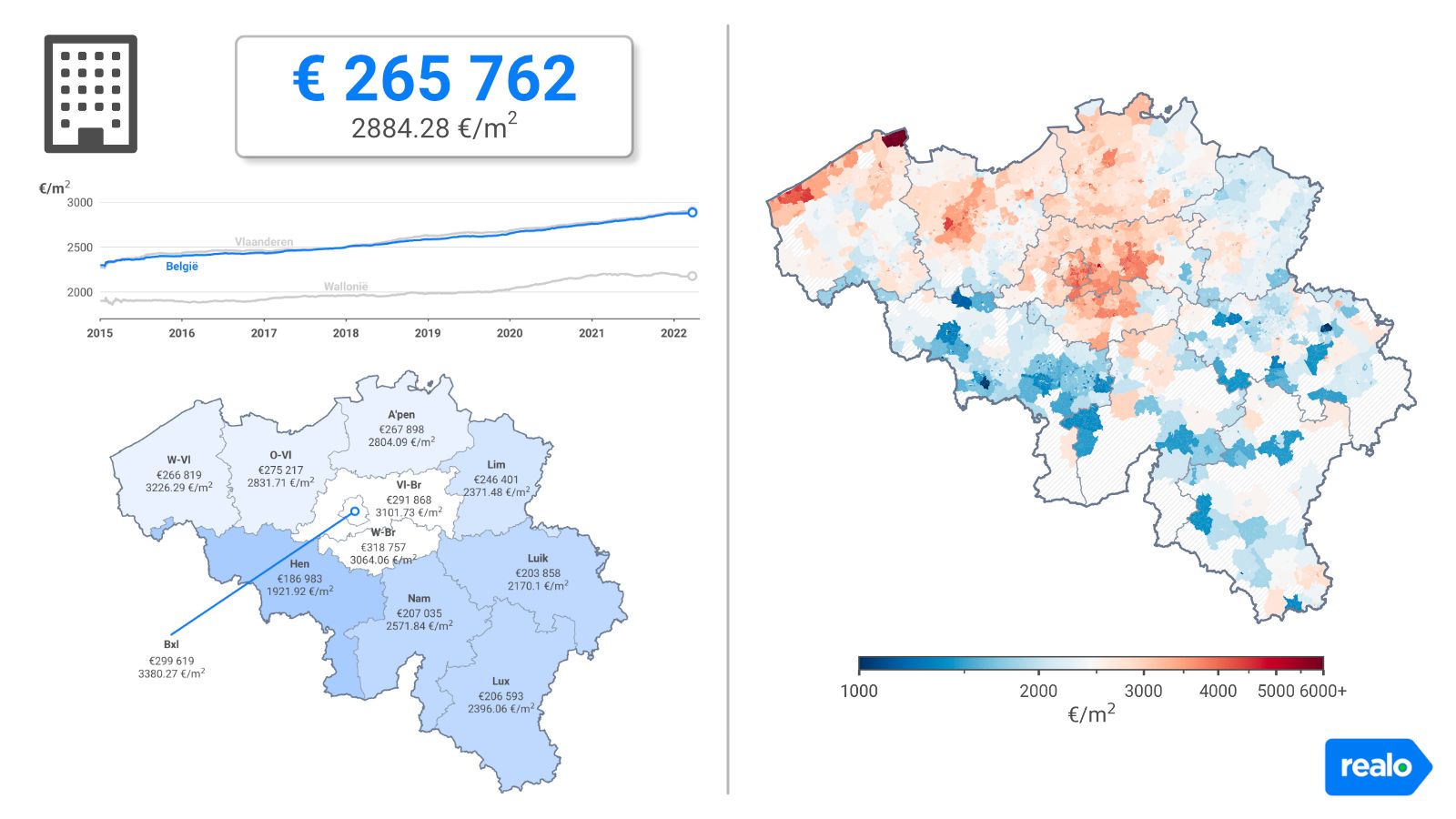

Compared to the previous 12 months, average house prices rose by 2.64% in the last quarter to € 304 743. Flat prices rose less strongly on average to € 265 762, an adjustment of 0.68%. In other words, in 2022 you paid on average an additional price of € 7921 for a house or € 1790 for a flat.

When we look at the regional level, we see that this increase is almost entirely due to higher prices in Flanders, where houses became 3.3% more expensive and flats 1.26% more so. In contrast, house prices in Wallonia rose only by 0.74% and flat prices actually fell by 1.56%.

Cooling down of the market

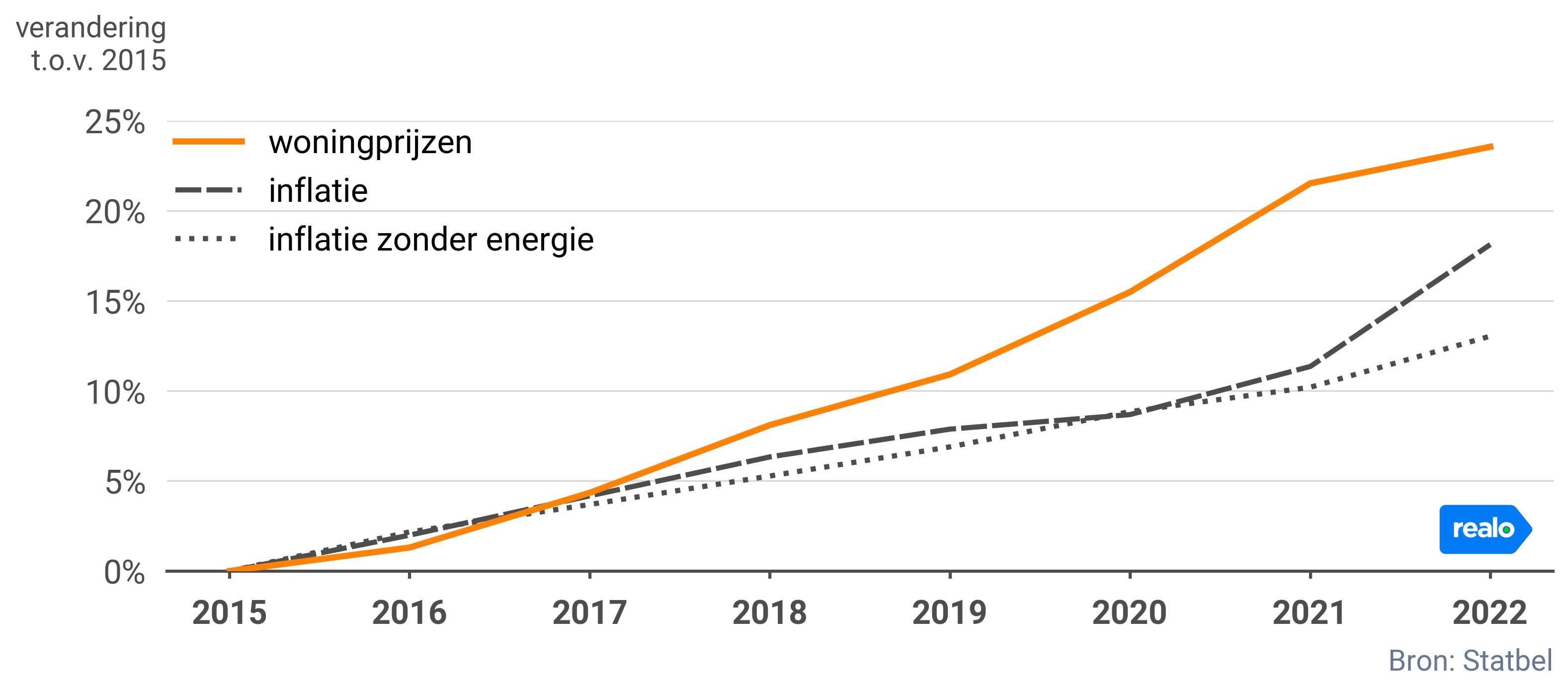

Despite the fact that house prices are still on an upward trend, certain indicators point to a cooling of the property market. The first thing to notice when looking at the change in prices compared to reference year 2015 is that average prices have increased by 23.5%. This increase is fairly consistent at around 3 to 4 percentage points per year. In 2020 and certainly in 2021, we see a sudden steeper rise in prices. But for now, we see that this trend will not continue in 2022 and prices will rise again at a pre-2020 pace.

Secondly, we can see that, from 2018 onwards, house prices started to rise more strongly than inflation. What is particularly striking is that inflation is currently growing exponentially, while house prices do not seem to be following the same trend (any more). Even when we take the rising energy prices into account, we still see a stronger growth of inflation. The fact that house prices are currently following a reverse trend may also indicate a cooling of the real estate market.

Moreover, the average interest rate started to rise again in January 2022, which in theory could lead to lower property prices. Indeed, new buyers who have to take out a loan with a higher interest rate will be able to borrow less for a property, which means that property prices will not be able to rise as quickly.

Now it is a matter of waiting to see how the figures will evolve in 2022 after a generally 'more active' second quarter in the property market, combined with rising inflation and interest rates.

A house in Hainaut or a flat in Walloon Brabant?

Walloon Brabant remains by far the most expensive province in Belgium (Brussels excluded), paying an average of € 398 759 for a house in the last quarter. The fact that this is a decrease of 1.33% compared to last year does not help the title of most expensive province. Moreover, prices for flats did go up, by a whopping 7.26%, with an average of € 329 057 paid for a flat in the last quarter.

Hainaut is by far the cheapest province. With 7 municipalities in the top 10 of cheapest flats and a staggering 9 of the 10 municipalities with cheapest houses, this should not come as a surprise. The relatively scarce flats in the province were sold for an average of € 185 678. Then you were better off buying a house, the average price there was almost as much as a flat at € 189 589, half the average house price in Walloon Brabant.

Sint-Martens-Latem remains the most expensive municipality in which to buy a house (average € 791 978), but in terms of living space, you will have to pay an extra € 836 per square metre in Sint-Pieters-Woluwe. If we also take flats into consideration, then you get the least value for your money in Knokke-Heist, both for houses (€ 3563/m2) and flats (€ 6279/m2) the coastal municipality lands on top of the most expensive municipalities in terms of price per square meter.

The Brussels region still has the highest concentration of expensive municipalities (Ixelles, Woluwe-Saint-Pierre, Watermael-Boitsfort, Woluwe-Saint-Lambert, Auderghem, Uccle). In Woluwe-Saint-Lambert, the price per square metre increased even more, by 12.55%. On the other hand, flats in Ixelles, for example, fell by 4.41%, which still represents a price of € 4088/m2. But even a generally cheaper commune such as Anderlecht saw a sharp increase in flat prices during the last quarter, up 7.91% on the previous year. In Vorst, prices also rose by 8.66%.

Among the provincial capitals, Bruges and Hasseltgo against the general trend when it comes to flats. In the last quarter, they paid 8.66% and 6.17% less for a flat, respectively. If you want to buy a house, it is better not to go to Ghent or Namur, where house prices rose by 4.54% and 9.9% compared to last year.

Read about the current state of rental prices here.